What is AMR? - GroupAccess - Alabama

Health and Dental Navbar

Annual Maximum Rollover (AMR) Benefits

Taking Care of Yourself Has Never Been So Rewarding!

Every Dental® Blue Plan Includes AMR Benefits!

Annual Maximum Rollover (AMR) benefits allow members to carry over up to $500 dollars of their unused calendar year maximum. This maximum is the amount that Blue Cross pays towards your dental services each year.

Here's How It Works

1

Visit

Visit your dentist for routine diagnostic and preventative services.

2

Submit Claim

A claim will be submitted for your visit.

3

Rollover

If your annual claims do not exceed the plan max, you earn rollover - up to $500 for the year.

4

AMR Account

The money in your AMR account can total up to $1,000 and be used for future dental services.

Example Dental Blue Plan

Sample plan below may differ from plan purchased.*

$2,000

calendar year maximum

$500

maximum rollover amount

$1,000

threshold (amr account maximum)

Calendar Year Maximum

Claims

New Rollover Funds for Future Years

Current AMR Account Balance

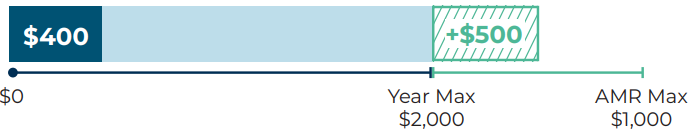

Year 1

John has a $2,000 Calendar Year Maximum

AMR Account Balance: $0

- Completes 2 Diagnostic & Preventative Services.

- Submits additional dental claim.

- All claims paid are less than $2,000.

Rollover is $500.

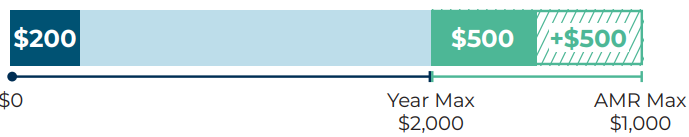

Year 2

John has a $2,000 Calendar Year Maximum

AMR Account Balance: $500

- Completes 2 Diagnostic & Preventative Services.

- No additional dental claims.

- All claims paid are less than $2,000.

Rollover is $500 (adding $500 from last year).

Year 3

John has a $2,000 Calendar Year Maximum

AMR Account Balance: $1,000

- Completes 2 Diagnostic & Preventative Services.

- No additional dental claims.

- Total claims paid are less than $2,000.

- No rollover is received as AMR account is already at the $1,000 threshold.

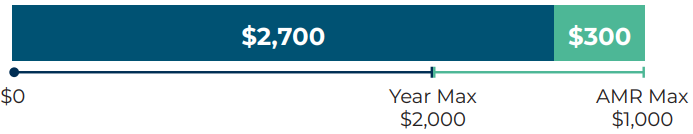

Year 4

John has a $2,000 Calendar Year Maximum

AMR Account Balance: $1,000

- Completes 2 Diagnostic & Preventative Services.

- Submits additional dental claim of $2,500 for root canal and crown.

- Total claims paid are $2,700 ($2000 from plan + $700 from AMR = no out-of-pocket costs.

- $300 remains in AMR account.

Important Notes

You have to

complete

2

Diagnostic and Preventative Services every year

amr

available

for all members

on the contract

amr benefits

never expire

as long as the

contract is active

*Blue Cross and Blue Shield of Alabama is using a sample plan for example purposes only. Actual benefits may differ from those included in the sample plan.